The Impact of the Sino-US Trade War on the Sustainable Development of China's Industrial Supply Chain – Empirical Study based on Data from 2018 to 2019

Main Article Content

บทคัดย่อ

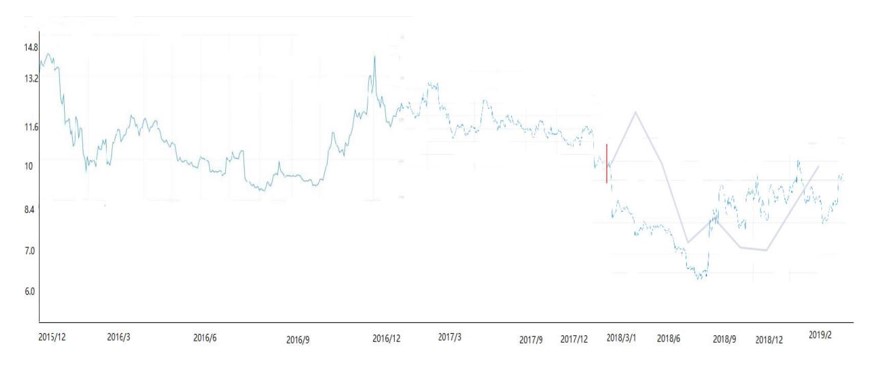

This article examines the economic impact of the Sino-US trade war on China and the US by studying its effect on several companies and analyzing changes in macroeconomic indicators. Time series analysis is used to compare the actual situation of selected enterprises with the forecasted situation to determine the positive or negative effects of the trade war. Linear regression analysis is used to compare changes in China's macroeconomic indicators before and after the trade war began. The study finds that the growth rate of China's GDP has increased to some extent after the start of the trade war, while the US consumer index has declined due to increased tariffs on industrial and agricultural products. The supply of base currency has also fluctuated more since the start of the trade war. The study analyzes the stock trends of various industry sectors, including steel, chemicals, communication equipment, biotech, trade, electronics, pharmaceuticals, banking, and logistics, and finds that the trade protection of individual companies has a positive impact due to tariffs, but the industry sector is still negatively affected. Linear regression analysis is used to analyze US macro data, which shows that after the trade war broke out, the growth rate of US imports of goods and services slowed down, inflation rose slightly, government savings decreased, and the growth rate of GDP increased.

Article Details

อนุญาตภายใต้เงื่อนไข Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

บทความนี้ได้รับการเผยแพร่ภายใต้สัญญาอนุญาต Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International (CC BY-NC-ND 4.0) ซึ่งอนุญาตให้ผู้อื่นสามารถแชร์บทความได้โดยให้เครดิตผู้เขียนและห้ามนำไปใช้เพื่อการค้าหรือดัดแปลง หากต้องการใช้งานซ้ำในลักษณะอื่น ๆ หรือการเผยแพร่ซ้ำ จำเป็นต้องได้รับอนุญาตจากวารสารเอกสารอ้างอิง

Bloomburg. (2018). U.S.-China Trade War Spells Divorce of World's Biggest Economies, Market Economy, retrieved on 2022/11/30 from https://www.bloomberg.com/news/articles/2018-09-19/u-s-china-trade-war-spells-divorce-of-world-s-biggest-economies?leadSource=uverify%20wall

Bu H.L.; Mao.G.(2019) Strategic considerations and cultural choices of the United States in provoking the Sino-US trade war; Nanfang Lunchuang;2019-01

Cai, H., Gao, J., & Li, H. J. (2018). The Impact of Sino-US Trade War on China's Financial Industry; Banker; 2018-08

Frenkel, J. A. (2018). Reflections on Central Banking, Protectionism and Globalization. Russian Journal of Money and Finance Bank of Russia. 77(1), pages 108-123, March. Handle: RePEc: bkr: journl: v:77:y:2018:i:1p:108-123 DOI: 10.31477/rjmf.201801.108

Flassbeck, H. (2018). Exchange rate determination and the flaws of mainstream monetary theory • Rev. Econ. Polit. 38 (1) • Jan-Mar 2018 • https://doi.org/10.1590/0101-31572018v38n01a0

Hufbauer G.H. and Jung E.J. (2020) What's new in economic sanctions? November 2020 European Economic Review 130(90):103572 DOI: 10.1016/j.euroecorev.2020.103572

Jiang, Y.Q.& Gao, Y. (2018). A Brief Discussion on the Impact of Sino-US Trade War on China's Financial Industry. Times Finance. 2018-35

Li, C.D. (2018). The progress, impact and countermeasures of the Sino-US trade war. China Market. 2018-24

Radar, B. (2018). The Prolongedness and Severity of the Sino-US Trade War. Nankai Journal (Philosophy and Social Science Edition). 2018-03

Shi, Y. (2018). An Analysis of the Sino-US Trade War; Northern Economics and Trade;2018-12

Tan, W. Z. (2018). A ‘geopolitical recession’ has arrived and the US-led world order is ending, Ian Bremmer says PUBLISHED WED. OCT 10 20185:21 AM EDTUPDATED WED, OCT 10 20185:21 AM EDT retrieved on 2022/11/30 from https://www.cnbc.com/2018/10/10/china-emerging-markets-are-rising-us-led-order-ending-ian-bremmer.html

Theodore, H., Moran, T.H., & Oldenski, L. (2012). Foreign Direct Investment in the United States Benefits, Suspicions, and Risks with Special Attention to FDI from China (2012) Peterson Institute for International Economics ISBN: 9780881326604 retrieved on 2022/11/30 from https://cup.columbia.edu/book/foreign-direct-investment-in-the-united-states/9780881326604

Yuan, L.S. (2018). Sino-U.S. trade has made a huge contribution to the U.S. economy, and trade protection is unpopular. International Monetary Institute, 26, March 2018, retrieved on 2022/11/30 from http://www.imi.ruc.edu.cn/IMIsd/a068b945d0a348c79c0cbca2ab2a2515.htm

Zhang, H.B. (2018a). Developing an Open Economy at Higher Level Social Sciences Literature Press SSAPID: 101-8962-9011-09 ISBN: 978-7-5201-1886-6 retrieved on 2022/11/ 30 from https://id.ssap.com.cn/101-8962-9011-09

Zhang, M.N. (2018b). The Essence and Prospects of the Sino-US Trade War Thing Hong Kong. 2018-07-30 retrieved on 2022/11/30 from https://www.thinkhk.com/article/2018-07/30/28382.html

Zhang, Y. X. (2018c). On Sino-US Trade War;Pay Tax;2018-11

Zhou, X. (2019). Sino-US trade war: China's negative impact and countermeasures. Modern Commerce and Trade Industry. 2019-05 retrieved on 2022/11/30 from http://www.cnki.com.cn/Article/CJFDTotal-XDSM201905020.htm

Zhu, W. M. (2018). Thoughts brought about by the Sino-US trade war. Market Watch. 2018-0914), 5858.