Evaluating Sustainable Practices in Supply Chains: A Conceptual Framework for ESG Performance Assessment

Main Article Content

บทคัดย่อ

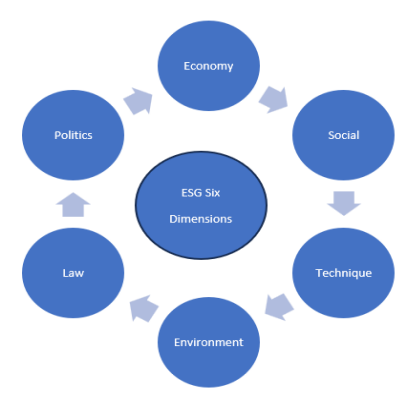

Assessing the sustainability of supply chains is a challenging research topic, and this study proposes a

possible conceptual framework through a review of previous research literature. The study first delves into the

impact of the supply chain at all levels and then proposes multiple variables that affect the sustainable supply

chain, including the overall performance of the supply chain, the economic impact, the environmental impact, the social impact, and so on. In terms of supply chain performance evaluation, the study further proposes two different concepts, one is to regard the supply chain as the weighted sum of the participating enterprises according to the performance evaluation method of general corporate governance, and the evaluation method is to use the performance of input and output as the basis for evaluation, and the other is to consider the supply chain as a whole and conduct overall performance evaluation from the perspective of sustainable supply

chain. At the end of this study, a possible conceptual architecture diagram is also presented as a reference for subsequent researchers.

Article Details

อนุญาตภายใต้เงื่อนไข Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

บทความนี้ได้รับการเผยแพร่ภายใต้สัญญาอนุญาต Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International (CC BY-NC-ND 4.0) ซึ่งอนุญาตให้ผู้อื่นสามารถแชร์บทความได้โดยให้เครดิตผู้เขียนและห้ามนำไปใช้เพื่อการค้าหรือดัดแปลง หากต้องการใช้งานซ้ำในลักษณะอื่น ๆ หรือการเผยแพร่ซ้ำ จำเป็นต้องได้รับอนุญาตจากวารสารเอกสารอ้างอิง

Armstrong, R. (2021). The ESG investing industry is dangerous. Financial Times, 24.

Arvidsson, S., & Dumay, J. (2022). Corporate ESG reporting quantity, quality, and performance: Where to now for environmental policy and practice? Business Strategy and the Environment, 31(3), 1091- 1110.

Astawa, I. K., Pirzada, K., Budarma, I. K., Widhari, C. I. S., & Suardani, A. A. P. (2021). The effect of green supply chain management practices on the competitive advantages and organizational performance. Polish Journal of Management Studies, 24(1).

Berk, J. B., & van Binsbergen, J. H. (2021, September 28). The Impact of Impact Investing. Stanford University and NBER. University of Pennsylvania and NBER.

Chung, J., & Michaels, D. (2019). ESG funds draw SEC scrutiny. Wall Street Journal.

Diez-Cañamero, B., Bishara, T., Otegi-Olaso, J. R., Minguez, R., & Fernández, J. M. (2020). Measurement of corporate social responsibility: A review of corporate sustainability indexes, rankings and ratings. Sustainability, 12(5), 2153.

Egels-Zandén, N., & Wahlqvist, E. (2007). Post-partnership strategies for defining corporate responsibility: The business social compliance initiative. Journal of business ethics, 70, 175-189.

Freiberg, D., Rogers, J., & Serafeim, G. (2020). How ESG issues become financially material to corporations and their investors. Harvard Business School Accounting & Management Unit Working Paper, (20-056).

Gelles, D. (2 0 2 3 ). How Environmentally Conscious Investing Became a Target of Conservatives. The New York Times. Retrieved. December 29,2023.

Giese, G., Nagy, Z., & Lee, L. E. (2021). Deconstructing ESG ratings performance: Risk and return for E, S, and G by time horizon, sector, and weighting. The Journal of Portfolio Management, 47(3), 94-111

Goebel, P., Reuter, C., Pibernik, R., Sichtmann, C., & Bals, L. (2 0 1 8 ). Purchasing managers' willingness to pay for attributes that constitute sustainability. Journal of Operations Management, 62, 44-58.

Holder, M. (2019). Global sustainable investing assets surged to $30 trillion in 2018. GreenBiz, April 8.

Jiang Y.P. (2003). The design of performance evaluation model for supply chain management: An empirical study of notebook industry Chung Yuan University/School of Business/Institute of International Trade/Master."

Lamba, N., & Thareja, P. (2021). Developing the structural model based on analyzing the relationship between the barriers of green supply chain management using TOPSIS approach. Materials Today: Proceedings, 43, 1-8.

Lee, K. H., Noh, J., & Khim, J. S. (2020). The Blue Economy and the United Nations’ sustainable development goals: Challenges and opportunities. Environment international, 137, 105528.

Li, T. T., Wang, K., Sueyoshi, T., & Wang, D. D. (2 0 2 1 ). ESG: Research progress and future prospects. Sustainability, 13(21), 11663.

McGuffog, T., & Wadsley, N. (1 9 9 9 ). The general principles of value chain management. Supply Chain Management: An International Journal, 4(5), 218-225.

Porter, M. E. (2001). The value chain and competitive advantage. Understanding business processes, 2, 50-66.

Roy, M. J., Boiral, O., & Paillé, P. (2 0 1 3 ). Pursuing quality and environmental performance: Initiatives and supporting processes. Business Process Management Journal, 19(1), 30-53.

Snyder, L. V., & Shen, Z. J. M. (2019). Fundamentals of supply chain theory. John Wiley & Sons.

Spekman, R. E., Kamauff, J., & Spear, J. (1999). Towards more effective sourcing and supplier management. European Journal of Purchasing & Supply Management, 5(2), 103-116.

Tarquinio, L., Raucci, D., & Benedetti, R. (2 0 1 8 ). An investigation of global reporting initiative performance indicators in corporate sustainability reports: Greek, Italian and Spanish evidence. Sustainability, 10(4), 897.

Tay, M. X. Y., & Tay, S. E. R. (2023, March). "Understanding Sustainability Practices Through Sustainability Reports and Its Impact on Organizational Financial Performance." In Proceedings of the 1 7th East Asian-Pacific Conference on Structural Engineering and Construction, 2022: EASEC-17, Singapore (pp. 343-352). Singapore: Springer Nature Singapore.

Velte, P. (2017). Does ESG performance have an impact on financial performance? Evidence from Germany. Journal of Global Responsibility, 8(2), 169-178.

Wicks, J. (2009). Local living economies: the new movement for responsible business. San Francisco: Business Alliance for Local Living Economies (BALLE).

Zhou, G., Liu, L., & Luo, S. (2022). Sustainable development, ESG performance and company market value: Mediating effect of financial performance. Business Strategy and the Environment, 31(7), 3371-3387.

Zimmer, K., Fröhling, M., & Schultmann, F. (2 0 1 6 ). Sustainable supplier management–a review of models supporting sustainable supplier selection, monitoring, and development. International journal of production research, 54(5), 1412-1442.